We are in permanent contact with the main players in the energy market. We advise our clients in the definition of their strategy and the main guidelines for the management of their commercial projects.

The alternative to having in-house equipment, but with lower costs and in plug&play format.

Optimize Energy is the equivalent of an asset manager or insurance broker, but in the electricity market.

Our solution:

Managed Merchant

Optimize Energy provides you with a multi-disciplinary plug-and-play team specialised in:

- Optimising merchant plant revenues

- Managing operational risks in electricity markets

The advantages of using Optimize Energy

Faster and more effective solution than setting up your own equipment.

Self-financing: the service is paid for out of plant revenue.

Plant revenue can be up to 6 times the cost of the service.

Facilitates project financeability.

Available from 5 MW.

Service with coverage in Spain, Italy, United Kingdom.

Our services

- Initial training

- Market information

- Definition of management strategy

- Analysis of derivative recommendations

- Hedging management

- GoO’s sale management

- Presentation and analysis of PPA alternatives (recommendations)

- Negotiation of agency contract to optimise price and merchant operations

- DA, MI & SSAA strategy

- Quarterly reporting

Optimize enables financial investors to have the same tools as utilities and oil & gas companies in merchant operations.

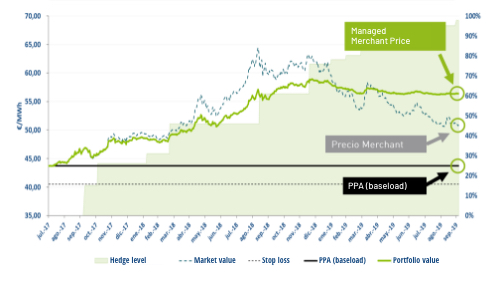

Optimize Energy can optimise the risk-return balance of merchant projects.

Our clients

Success stories

Risk policy design for IPP company with solar assets in Spain and Italy.

Optimize Energy established a risk policy for this client to act as a framework for the coordination and operation of active management of the energy produced for a portfolio of solar assets. Given the merchant exposure of a certain volume of energy, the client needed to have the appropriate visibility to capture opportunities that would allow them to increase revenues and thus the profitability of the sale of energy.

Expected curtailment study on solar and wind portfolio for several Spanish provinces.

The services provided by Optimize Energy consisted of helping an investment fund to obtain the expected curtailment estimates for the next 5 years in several Spanish provinces where it plans to install renewable generation assets (solar and wind). This information allowed them to incorporate it and thus enrich their project finance for the financing of their projects by incorporating operating scenarios closer to the current reality.

Revenue model for battery hybridisation with wind farm

The service consisted of the generation of a 10-year expected revenue scenario for a hybrid system between a 50 MW installed capacity wind farm and a 10 MW capacity battery. Optimize used our in-house developed model to simulate an optimised operation in both the spot market and the Secondary Regulation market, within the adjustment services markets available to Red Eléctrica to ensure stability in the national electricity system.

Tendering process for PPA counterparties and Representative Agent in the marketplace

An important European IPP company relied on our services for the organisation and coordination of two parallel processes. One of them for the search of counterparties, both corporate and trading houses, for the negotiation and signing of a 10-year PPA agreement for the sale of part of the energy generated in its portfolio. The second focused on advising and organising a negotiation process and the signing of a contract with a Representative Agent for its portfolio of plants in Spain, designing the corresponding RFQ for the process, contacting more than 20 agents in the Spanish market and, after receiving the offers, carrying out the corresponding weighted valuation and shortlist of final candidates for negotiation.

Are you interested in hiring us?

if you have any doubt and/or are interested in hiring Optimize Energy you can contact us, we will be delighted to help you.