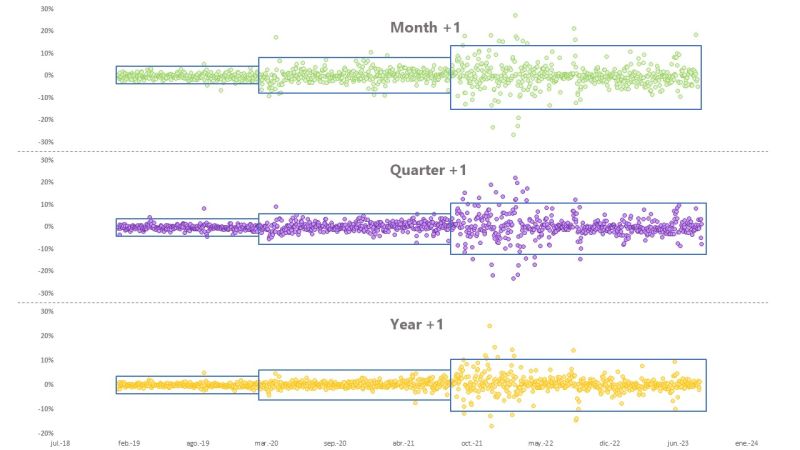

Optimize Energy has analysed the evolution of month, quarter and calendar ahead (+1) products in order to show the change since 2019 and how active energy and risk management could have benefited from it.

We distinguish two major catalysts in the movement of futures, the #COVID and the rise in gas prices due to the war between #Russia and #Ukraine.

As expected, the most traded product for the short term, the Month +1, is the one that registers the greatest variation when these “black swans” occur, while Quarter and Cal +1, despite also suffering from this #volatility, maintain more moderate movements.

We can also see how the average daily variation has been increasing. As in the spot market, where we came from a market of 40-50 €/MWh, a new “normality” is now established around 90-100 €/MWh. This movement can also be seen in financial products, which have gone from moving an average of +/-0.5% in 2019, to the current situation with +/- 2.5%.

These volatilities have a direct impact on the valuation of #generation assets, #revenue expectations and capital needs when hedging in the markets.

Efficient and professional #risk management helps to mitigate all these impacts and also allows, if carried out properly, to significantly increase the income level of generation portfolios.

If you want to know more, contact us and let’s talk!